What is the present value of a $100 perpetuity if the interest rate is 7?

a. Present value of perpetuity=Annual cash flows/interest rate At 7%: Present value of perpetuity=100/0.07 =$1428.57(Approx) At 1…

| Description | Amount |

|---|---|

| Amount per payment (a) | $100 |

| Rate of interest (b) | 6% |

| Present value of perpetuity (a/b) | $1,666.67 |

Present value is the value today of an amount of money in the future. If the appropriate interest rate is 10 percent, then the present value of $100 spent or earned one year from now is $100 divided by 1.10, which is about $91.

Hence, the present value of a $100 perpetuity discounted at 5% is $2,000 and not $5,000, making the statement false.

Answer and Explanation:

So, a $100 at the end of each year forever is worth $1,000 in today's terms.

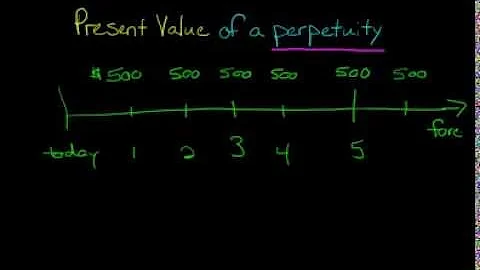

The Present Value of Perpetuity is calculated using the formula PV = C/r where PV stands for Present Value, C stands for cash flow per period, and r represents the discount rate.

PV = C / (r – g)

PV = Present value. C = Amount of continuous cash payment. r = Interest rate or yield.

The answer, $85.73, tells us that receiving $100 in two years is the same as receiving $85.73 today, if the time value of money is 8% per year compounded annually. (“Today” is the same concept as “time period 0.”)

In this case, we want to find the present value of $100 that we will receive at the end of three years, with an 8% annual discount rate. The result is approximately $79.38. Hence, the present value of $100 received at the end of three years, assuming an annual 8% discount rate, is about $79.38.

What's the present value of $100 to be received in 3 years if the interest rate is 4%, annual compounding? N = 3, I/YR = 4, PMT = 0, FV = 100, and then solve for PV = $88.90.

What is the value of a $1000 per year perpetuity discounted back to the present at 8%?

Present value = 1000/0.08 = $ 12,50…

Using the formula for calculating the present value of a perpetuity, PV = C / r, with a cash flow of $600 and an interest rate of 5%, the present value of a $600 perpetuity is calculated to be $12,000.

The present value of a $1,000 perpetuity discounted back to the present at 8 percent is $12,500. For example, perpetuities are figured as the following: P = $1,000/0.08 = $12,500.

Answer and Explanation:

Option B ($83) is the correct answer.

| If you invest $100 a month for this many years... | ...this is how much you'll end up with. |

|---|---|

| 10 | $21,037.40 |

| 15 | $41,939.68 |

| 20 | $75,603.00 |

| 25 | $129,818.12 |

Expert-Verified Answer

The present value of $1,000 to be received in 10 years if the interest rate is 12% compounded semiannually is $311.80.

The present value of a perpetuity is equal to the payment on the annuity, PMT, divided by the interest rate, I:PV=PMT/I.

There are a few examples of perpetuities in existence today. Real estate, certain types of bonds, and stocks that pay dividends are all perpetuities.

- The formula for PV looks like this:

- PV = FV/(1+r)n.

- The explanation for each element is:

- PV = the present value in today's money FV = the projected future value of the money r = the expected rate of return, interest rate, or inflation rate.

Answer. In this case, C = 300 and r = 3% = 0.03 per 6 months. So, the correct answer is c) 10,000.

What is a perpetuity quizlet?

Perpetuity is what? an infinite stream of cash flows. Payments are of equal size at equal intervals and continue forever. How do you find the PV (present value) of a perpetuity? Simply divide the annual payment by the discount rate.

Answer and Explanation:

Opportunity cost (r) is 9%. Hence, the present value of $100 to be received 10 years from today is $42.241.

Answer and Explanation:

The present value of the annuity is $442.26.

Answer and Explanation:

The present value of $100 to be received in 3 years $75.13.

The present value of $100 due to be received after 3 years under the discount rate of 10% is $75.13. The present value of $100 due to be received after 3 years under a discount rate of 0% is $100. Where, PV = Present value.

References

- https://www.nasdaq.com/articles/got-%24500-to-invest-monthly-this-exchange-traded-fund-can-make-you-a-millionaire.

- https://saylordotorg.github.io/text_money-and-banking-v2.0/s07-02-present-and-future-value.html

- https://homework.study.com/explanation/what-is-the-present-value-of-an-annuity-of-100-received-at-the-end-of-each-year-for-7-years-the-first-payment-will-be-received-one-year-from-today-the-discount-rate-is-13.html

- https://homework.study.com/explanation/what-is-the-current-value-of-100-000-after-10-years-if-the-discount-rate-is-12-percent-a-15-100-b-32-200-c-40-200-d-44-100.html

- https://homework.study.com/explanation/what-is-the-present-value-of-250-received-at-the-beginning-of-each-year-for-21-years-assume-that-the-first-payment-is-received-today-use-a-discount-rate-of-12.html

- https://www.chegg.com/homework-help/questions-and-answers/13-s-present-value-perpetuity-pays-250-per-year-appropriate-interest-rate-5-4-750-5-000-5--q38478468

- https://www.quora.com/How-much-do-I-need-to-invest-to-make-2-500-a-month

- https://www.nerdwallet.com/article/banking/how-much-interest-can-i-earn-on-100-1k-or-10k

- https://www.nasdaq.com/articles/do-this-for-$4000-in-dividend-income-every-month

- https://tools.carboncollective.co/future-value/3000-in-20-years/

- https://www.chegg.com/homework-help/questions-and-answers/-present-value-1-000-perpetuity-discounted-back-present-8-percent-j-present-value-1-000-an-q91511978

- https://www.fool.com/the-ascent/buying-stocks/articles/this-is-how-much-money-you-can-make-by-investing-10k/

- https://www.studysmarter.co.uk/explanations/business-studies/corporate-finance/present-value-of-perpetuity/

- https://carminemastropierro.com/2000-month-passive-income/

- https://www.chegg.com/homework-help/questions-and-answers/5-16-5-17-present-value-perpetuity-present-value-100-perpetuity-interest-rate-7-interest-r-q57822927

- https://homework.study.com/explanation/what-would-the-future-value-of-100-be-after-5-years-at-10-compound-interest.html

- https://medium.com/@Levente22/9-simple-tricks-to-make-an-extra-2-500-each-month-at-home-0b6e0e6392ef

- https://brainly.com/question/34758529

- https://finance.yahoo.com/news/500-every-month-passive-income-130041730.html

- https://www.quora.com/I-want-to-earn-1-000-USD-every-month-from-dividends-How-much-do-I-have-to-invest-and-where

- https://www.forbes.com/advisor/banking/savings/millionaire-calculator/

- https://www.chegg.com/homework-help/questions-and-answers/present-value-formula-cash-flow-expected-one-period--pv-1-r-c1-b-pv-c1-r-c-pv-c1-1-r--d-pv-q79195246

- https://www.gobankingrates.com/investing/stocks/how-to-make-1000-a-month-in-dividends/

- https://homework.study.com/explanation/calculate-the-present-value-of-1-000-to-be-received-in-10-years-with-a-discount-rate-of-5.html

- https://www.forbes.com/sites/pattieehsaei/2023/10/12/you-can-afford-to-invest-start-with-just-100-per-month/

- https://www.fool.com/the-ascent/personal-finance/articles/how-long-does-it-take-to-become-a-millionaire/

- https://homework.study.com/explanation/an-investment-of-100-pays-an-interest-of-2-5-per-quarter-what-will-be-the-value-of-this-investment-at-the-end-of-3-years.html

- https://www.doubtnut.com/qna/51238398

- https://www.umsl.edu/~kummerd/PPT/Chap6/tsld040.htm

- https://brainly.com/question/29222325

- https://www.coursesidekick.com/finance/2085220

- https://brainly.com/question/30506910

- https://www.chegg.com/homework-help/questions-and-answers/6-present-value-rs-1000-due-2-years-5-per-annum-compound-interest-according-interest-paid--q91615835

- https://www.cuemath.com/questions/what-would-be-the-value-of-dollar100-after-10-years-if-you-earn-11-percent-interest-per-year/

- https://brainly.in/question/58351145

- https://www.wallstreetprep.com/knowledge/present-value-pv/

- https://www.investopedia.com/terms/p/presentvalue.asp

- https://brainly.com/question/31201024

- https://homework.study.com/explanation/what-s-the-present-value-of-a-perpetuity-that-pays-100-per-year-if-the-appropriate-interest-rate-is-6.html

- https://brainly.com/question/37139801

- https://homework.study.com/explanation/the-present-value-of-100-to-be-received-10-years-from-today-assuming-an-opportunity-cost-of-9-percent-is.html

- https://homework.study.com/explanation/what-is-the-present-value-of-receiving-1-000-000-twenty-years-from-now-if-you-discount-the-future-at-10-per-year.html

- https://smartasset.com/investing/how-much-interest-would-10-million-earn

- https://www.chegg.com/homework-help/questions-and-answers/present-value-21-797-received-one-year-discount-rate-51-percent-begin-array-l-20715-46-207-q107281881

- https://www.numerade.com/ask/question/what-is-the-present-value-of-1000-received-in-two-years-if-the-interest-rate-is-12-per-year-discounted-annually-08008/

- https://medium.com/@Levente22/7-proven-ways-to-make-5-000-9-000-per-month-in-passive-income-1aafbf025154

- https://homework.study.com/explanation/the-future-value-of-an-annuity-of-1-000-each-quarter-for-10-years-deposited-at-12-percent-compounded-quarterly-is-a-93-049-b-17-549-c-11-200-d-75-401.html

- https://tools.carboncollective.co/future-value/100-in-5-years/

- https://finance.yahoo.com/news/6-smart-ways-turn-20-140040613.html

- https://homework.study.com/explanation/what-is-the-present-value-of-100-to-be-received-in-3-years-if-the-appropriate-interest-rate-is-10.html

- https://homework.study.com/explanation/what-is-the-future-value-of-1-000-after-six-months-of-earning-12-annually-a-1-050-00-b-1-120-00-c-1-058-30.html

- https://homework.study.com/explanation/100-at-the-end-of-three-years-is-worth-how-much-today-assuming-a-discount-rate-of-100-percent-10-percent-and-0-percent.html

- https://medium.com/@Levente22/9-smart-passive-income-ideas-to-make-3-000-per-month-e15154bd558e

- https://www.investopedia.com/financial-edge/0709/so-you-wanna-be-a-millionaire-how-long-will-it-take.aspx

- https://www.fool.com/the-ascent/buying-stocks/articles/will-investing-100-a-month-really-make-a-difference-in-your-net-worth/

- https://brainly.com/question/30528704

- https://fundingsouq.com/ae/en/blog/what-happens-to-50k-over-20-years/

- https://www.calculator.net/compound-interest-calculator.html

- https://homework.study.com/explanation/the-future-value-of-a-1000-investment-today-at-8-percent-annual-interest-compounded-semiannually-for-5-years-is-blank.html

- https://www.med.uio.no/studier/sensur/euhem-og-hepma/hfin4210/2019/hfin4210-var-2019.pdf

- https://www.gobankingrates.com/money/making-money/best-ways-to-double-5000-dollars/

- https://www.nasdaq.com/articles/graham-stephan:-how-i-make-an-extra-$100-every-day

- https://homework.study.com/explanation/present-value-of-110-000-expected-to-be-received-one-year-from-today-at-an-interest-rate-discount-rate-of-10-per-year-is-a-121-000-b-100-000-c-110-000-d-none-of-the-above.html

- https://quizlet.com/433358033/34-valuingcashflowsatdifferentpointsintime-flash-cards/

- https://www.accountingcoach.com/present-value-of-a-single-amount/explanation/3

- https://talkmarkets.com/content/how-much-money-do-i-need-to-invest-to-make-3000-a-month?post=431352

- https://quizlet.com/376184604/fin-3320-exam-2-flash-cards/

- https://homework.study.com/explanation/what-is-the-present-value-of-500-00-to-be-paid-in-two-years-if-the-interest-rate-is-5-percent-a-453-51-b-500-00-c-476-25-d-550-00.html

- https://quizlet.com/300453611/fina-5170-chp2-flash-cards/

- https://quizlet.com/explanations/questions/what-is-the-present-value-of-a-600-perpetuity-if-the-7f6cabba-961bd74d-8c8c-4093-a9d8-2aa84177c1ff

- https://ocw.un-ihe.org/course/view.php?id=70§ion=5

- https://quizlet.com/explanations/questions/what-is-the-present-value-of-a-250-payment-in-one-year-when-the-discount-rate-is-6-percent-41bede32-99b55024-0c4d-437b-a8dc-726f30ca6285

- https://mydividendsnowball.com/how-i-made-1000-a-month-in-dividend-income/

- https://www.investopedia.com/terms/f/futurevalue.asp

- https://www.cuemath.com/questions/what-is-the-future-value-of-dollar10000-on-deposit-for-2-years-at-6-simple-interest/

- https://brainly.com/question/39944768

- https://www.numerade.com/ask/question/what-is-compounding-whats-the-difference-between-simple-interest-and-compoundinterest-what-would-the-future-value-of-100-be-after-5-years-at-10-compoundinterest-at-10-simple-interest-16105-1-95727/

- https://brainly.com/question/30884634

- https://homework.study.com/explanation/how-much-is-100-at-the-end-of-each-year-forever-at-10-interest-worth-today.html

- https://homework.study.com/explanation/calculate-the-present-value-of-a-1-000-lump-sum-received-3-years-from-now-if-the-market-interest-rate-is-5.html

- https://www.chegg.com/homework-help/questions-and-answers/chapter-4-application-1-simple-present-value-present-value-250-paid-two-years-interest-rat-q46067638

- https://app.myeducator.com/reader/web/1123a/topic02/fw51q/

- https://homework.study.com/explanation/what-is-the-present-value-of-100-to-be-paid-in-2-years-at-an-interest-rate-of-10-percent.html

- https://homework.study.com/explanation/you-expect-to-receive-a-payment-of-600-one-year-from-now-answer-the-following-questions-and-show-your-calculations-a-the-discount-rate-is-6-what-is-the-present-value-of-the-payment-to-be-received-b-suppose-that-the-discount-rate-rises-to-7.html

- https://money.usnews.com/money/retirement/articles/how-can-i-earn-100-200-or-500-per-month-in-guaranteed-income-in-retirement

- https://brainly.in/question/32710804

- https://homework.study.com/explanation/what-is-the-present-value-of-5-600-when-the-interest-rate-is-8-and-the-return-of-5-600-will-not-be-received-for-15-years.html

- https://www.bartleby.com/questions-and-answers/whats-the-future-value-of-dollar100-after-3-years-if-the-appropriate-interest-rate-is-8percent-compo/4a49e03c-93e8-46f9-9f68-94e520b4a0cd

- https://brainly.com/question/37271118

- https://www.cuemath.com/questions/the-present-value-of-dollar1000-to-be-received-in-5-years-is-if-the-discount-rate-is-1278/

- https://www.top1markets.com/insights/Make-500-a-Month-in-the-Dividends-pro

- https://www.morningstar.com/markets/when-will-fed-start-cutting-interest-rates

- https://tools.carboncollective.co/future-value/5000-in-20-years/

- https://finance.yahoo.com/news/much-interest-earn-1-million-150000229.html

- https://homework.study.com/explanation/assuming-the-interest-rate-is-8-percent-what-is-the-present-value-of-1-000-to-be-received-in-four-years.html

- https://homework.study.com/explanation/how-long-will-it-take-for-a-2-000-investment-to-double-in-value-assume-that-the-interest-rate-is-8-percent.html

- https://homework.study.com/explanation/using-time-value-of-money-tables-calculate-the-future-value-of-550-six-years-from-now-at-7-percent.html

- https://finance.yahoo.com/news/much-money-live-entirely-off-204845865.html

- https://homework.study.com/explanation/state-true-or-false-and-justify-your-answer-the-present-value-of-a-100-perpetuity-discounted-at-5-is-5-000.html

- https://themillennialmoneywoman.com/passive-income-ideas/

- https://quizlet.com/216677237/perpetuities-flash-cards/

- https://smartasset.com/investing/how-to-make-500-a-month-in-passive-income

- https://brainly.com/question/42255112

- https://www.econlib.org/library/Enc/PresentValue.html

- https://money.usnews.com/investing/articles/best-monthly-dividend-stocks-to-buy-now

- https://www.nerdwallet.com/article/investing/social-security/how-long-will-your-retirement-savings-last

- https://homework.study.com/explanation/what-is-the-future-value-of-100-after-3-years-if-it-earns-4-annual-compounding.html

- https://www.cuemath.com/questions/if-you-invest-10000-today-at-10-interest-how-much-will-you-have-in-10-years/

- https://www.wyzant.com/resources/answers/743555/find-the-present-value-of-10-000-if-interest-is-paid-at-a-rate-of-9-per-yea

- https://brainly.com/question/20813983

- https://learn.robinhood.com/articles/4FWd4Z39zN1qiTsmyTcA4j/what-is-a-present-value/

- https://brainly.com/question/47673982

- https://www.wikihow.com/Calculate-NPV

- https://homework.study.com/explanation/if-the-interest-rate-is-10-then-the-present-value-of-100-to-be-paid-in-2-years-is-a-80-b-83-c-120-d-121.html

- https://homework.study.com/explanation/good-news-you-will-almost-certainly-be-a-millionaire-by-the-time-you-retire-in-40-years-bad-news-the-inflation-rate-over-your-lifetime-will-average-about-3-2-a-what-will-be-the-real-value-of-1-m.html

- https://corporatefinanceinstitute.com/resources/data-science/perpetuity/

- https://study.com/academy/lesson/what-is-a-perpetuity-definition-formula.html